Mastering Subscription Billing and Affiliate Management with PayKickstart

Average Reading Time: 10min.

Table of Contents

- Introduction: Understanding the Importance of Subscription Billing

- Chapter 1: Exploring PayKickstart's Features for Maximizing Revenue

- Chapter 2: Case Studies: Successful Companies Using PayKickstart

- Chapter 3: Getting Started with PayKickstart: A Step-by-Step Guide

- Chapter 4: The Future of Subscription Billing and Affiliate Management

- Conclusion

Understanding the Importance of Subscription Billing

When I first heard about subscription billing, I honestly thought it was just another buzzword in the ever-evolving world of ecommerce. But as I delved deeper, I realized how fundamental this revenue model is for modern businesses. So, what exactly does subscription billing mean? Essentially, it's a way of generating revenue where customers pay a recurring fee for access to a product or service. Think about all those streaming services we subscribe to, software packages, or even your favorite gym membership. These are all concrete examples of subscription billing in action.

However, with great power comes great responsibility, and businesses that adopt this model often find themselves navigating a complex labyrinth of challenges. A few of the common hurdles include managing cancellations, dealing with payment failures, and ensuring consistent communication with subscribers. These issues are no small feat. In fact, a recent study revealed that 60% of subscription businesses struggle with retention. That number is staggering, and it emphasizes the need for a streamlined approach to subscription management.

There was a time when I subscribed to several services, only to cancel after a few months. Looking back, I realize that many of those companies didn't have a handle on their billing processes, which led to frustration on my end. Nearly 30% of subscription users cancel within the first three months, often because of these very issues. It’s a real eye-opener and a crucial lesson for businesses trying to secure long-term customer loyalty.

Now, on the flip side, when a subscription billing system functions seamlessly, the benefits are profound. I personally know the feeling of peace of mind that comes with a reliable subscription model. For businesses, a streamlined billing system can lead to significant reductions in churn rates and enhanced customer loyalty. That's a win-win in my book.

Breaking Down the Challenges

As I navigated the independent world of subscription billing, I came to recognize some of the most persistent challenges that businesses face:

Managing Cancellations: The customer has the freedom to opt-out at any moment. For businesses, this is like riding a rollercoaster of highs and lows. Understanding the "why" behind these cancellations can lead to more effective retention strategies.

Payment Failures: Missing payments can stall revenue flow, creating uncertainties that are incredibly tricky to navigate. Whether it's due to expired credit cards or insufficient funds, this aspect can erode customer trust.

Communication Gaps: Not maintaining an open line of communication can lead to disengagement. I’ve often found myself wondering why I wasn’t informed about changes or developments related to my subscriptions. Companies need to prioritize keeping their customers in the loop.

Benefits of a Streamlined Billing System

The importance of having a streamlined billing system can’t be stressed enough. From my experience, a robust and well-designed system can be a game-changer.

Adequate Tracking: It’s essential to have a system that lets you track payments seamlessly. This transparency can reinforce trust and satisfaction among customers.

Minimized Churn: By identifying at-risk customers early on and addressing their concerns proactively, businesses can reduce churn. I’ve seen firsthand how reaching out before a cancellation can retain customers who might have left otherwise.

Enhanced Customer Experience: A smooth checkout process adds value. Customers can subscribe, upgrade, or change their plans with ease. I would much rather work with a company that helps me navigate through subscription choices without unnecessary hurdles.

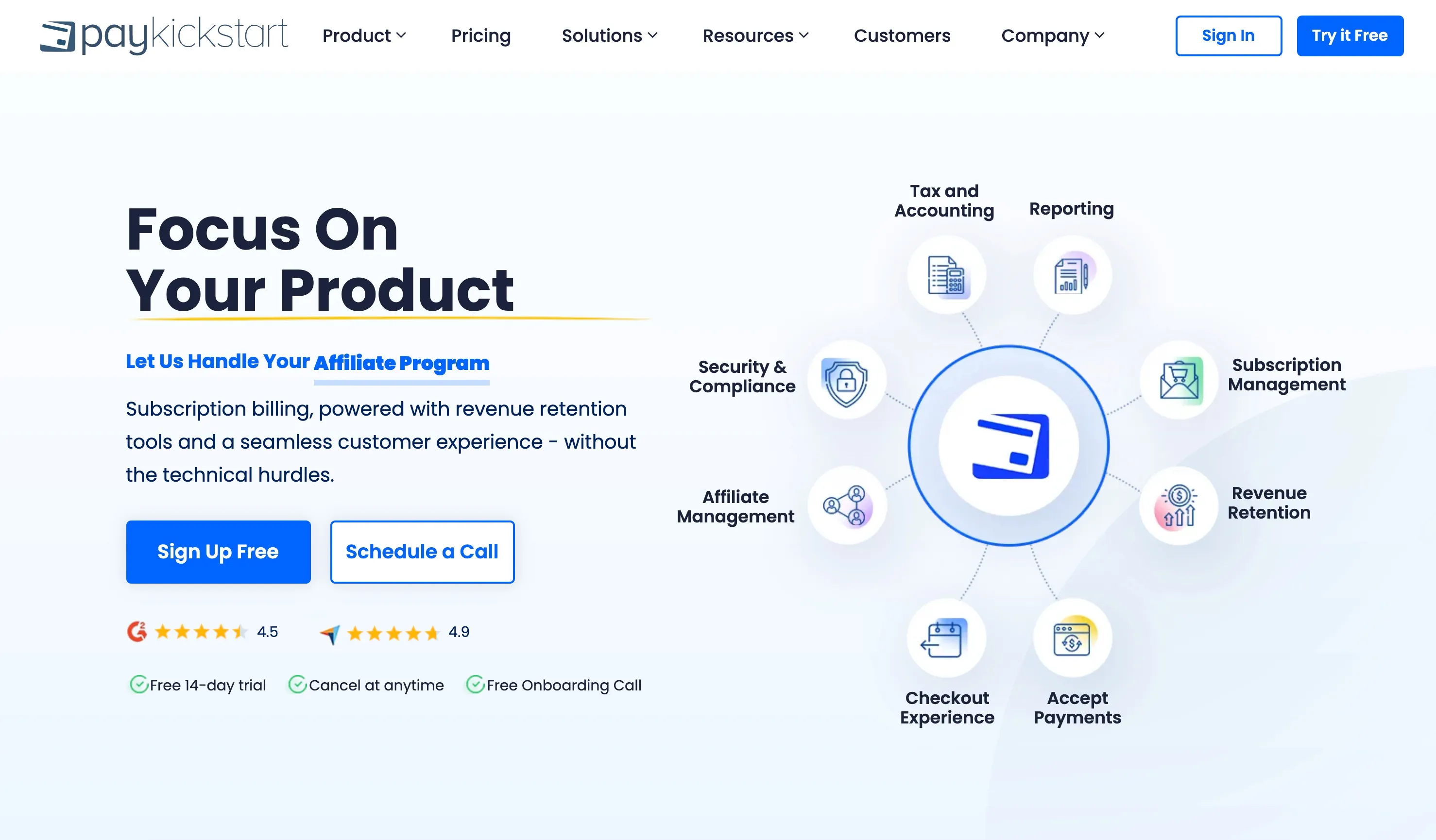

When I came across PayKickstart, it was like a breath of fresh air. This platform seems to have its finger firmly on the pulse of subscription billing. It acts as an extension of various departments—accounting, development, and marketing—making it incredibly versatile. The ability to accept payments, manage subscriptions, and analyze customer retention all in one place makes things much easier.

The Bigger Picture

"The future is subscription, and businesses need to adapt or fall behind." - Industry Expert

This quote really encapsulates the necessity of evolving alongside consumer expectations. The widespread switch to subscription-based services speaks volumes, and it’s clear that businesses need to place efficient subscription billing at the forefront of their operational strategy.

Revenue Growth & Affiliate Platform PayKickstart Handles: Billing System Checkout Experience Affiliate Management

For those businesses and entrepreneurs looking to thrive, leveraging a comprehensive platform like PayKickstart can significantly streamline these processes. With features that include detailed analytics, compliance security, and tax reporting, it's like having a personal assistant dedicated solely to the health of your subscription business.

Personal Reflections on Subscription Billing

Throughout my journey exploring subscription billing, the challenges and straightforward solutions have come to light. I believe that by innovating and adopting better systems, companies can build a sustainable base of loyal customers. The combination of technology with customer-centric approaches can yield powerful results. And it all starts with effective billing and management systems.

Exploring PayKickstart's Features for Maximizing Revenue

When I first began my journey in subscription-based business models, I quickly realized that navigating the financial landscape could be quite daunting. It was then that I stumbled upon PayKickstart, a platform that basically promised to streamline processes I never knew I deeply needed. Initially, I was skeptical—could one platform really handle everything from billing to affiliate management? After spending some time on the platform, here’s what I found.

Overview of PayKickstart's Offerings

PayKickstart stands as a transformative tool that blends a variety of functionalities to support subscription businesses. Think of it as an all-in-one solution capable of managing billing systems, optimizing checkout experiences, and maintaining comprehensive affiliate programs, all in one place. With this platform, I had the critical capabilities to scale my business without diving into endless technicalities.

From billing and accounting to customer management, PayKickstart's offerings are broad yet easy to navigate. As someone who often felt overwhelmed by technical constraints, the user-friendly interface made integration and operation feel seamless. Features such as advanced reporting and analytics really helped me lift the fog of complex financial data.

How Automation Can Enhance Customer Experience

One of the standout characteristics of PayKickstart is its remarkable automation features. Initially, managing subscriptions was a painstaking task. I often found myself bogged down, trying to track billing cycles and payment confirmations manually. I could never escape that nagging feeling of cart abandonment, as potential customers would frequently drop off during checkout. However, using PayKickstart’s automation tools brought about a stunning transformation.

With automated workflows, I was able to create a streamlined checkout process that not only secured transactions but also improved customer experience significantly. I witnessed a noticeable decline in cart abandonment rates, which was music to my ears. From personalized email follow-ups to nurturing campaigns, automation freed up a considerable amount of my time, allowing me to concentrate on strategic business growth instead of tedious tasks.

“Automate the mundane; focus on the extraordinary!” - Business Coach

This quote resonated with me throughout my experience with PayKickstart. By automating mundane tasks, I was able to turn my attention toward innovating my offerings and engaging with my audience more cooperatively, rather than just attempting to keep the wheels turning.

Integrating Payment Processing Easily

The integration capabilities offered by PayKickstart are another feature that delighted me. Setting up payment processing was once an ordeal full of technical jargon and headaches; now, it feels like a breeze. PayKickstart allows businesses to accept a variety of payment methods, which is a significant advantage in today's multi-currency, global marketplace. Gone are the days when I worried about whether I was manually entering payment data correctly.

With secure payment processing facilities at hand, I could focus on growth strategies rather than get lost in payment details. One stat I came across really drove the point home: PayKickstart can increase conversions by up to 40% with optimized checkout flows. And honestly, who doesn’t want to witness such growth?

Embracing Affiliate Management

Affiliate marketing has always been an area of fascination for me, but managing a team of affiliates can be a cumbersome process. Fortunately, PayKickstart specializes in affiliate management, making it easier for me to nurture influencer engagement, track referrals, and distribute payments—all from a single dashboard.

It feels like having a mini sales team working tirelessly for you. The affiliate program tools simplify the tracking of commissions, ensuring everyone is paid promptly and accurately. Establishing a rapport with affiliates became more manageable, allowing for better collaboration and coherence in marketing strategies.

Final Thoughts on PayKickstart

In summation, PayKickstart has become an indispensable resource for my business. By offering customizable solutions for billing and payments, combined with advanced tools for managing my affiliate program, it has simplified what was once an overwhelming set of processes. The robust automation features allow me to engage customers meaningfully while driving significant improvements in my overall revenue.

If you’re serious about scaling your subscription business and maximizing revenue without the technical turmoil, I wholeheartedly recommend exploring PayKickstart. It may just be the key to unlocking your business’s full potential!

Case Studies: Successful Companies Using PayKickstart

As I delved deeper into the world of subscription platforms, one name consistently stood out: PayKickstart. Initially, I was skeptical, like many others, about how a mere software solution could effectively help businesses scale and manage their subscription models. However, upon exploring various case studies, I have unearthed several real-world examples of companies thriving by utilizing PayKickstart. These stories of success were not just enlightening but also incredibly inspiring.

Real-World Examples of Business Success

The most compelling evidence of PayKickstart's impact can be seen in the stories of those who decided to make the leap into its ecosystem. One striking example is a SaaS company that reported an impressive 50% increase in engagement with its affiliates after incorporating PayKickstart into its operations. They weren't just observing a spark; this transformation breathed new life into their entire revenue model.

In this specific case study, the CEO noted,

"Our partnership with PayKickstart was a game-changer for our revenue model."

This statement resonates deeply as I analyze other businesses that have integrated PayKickstart into their operations, highlighting the correlation between its use and tangible revenue growth.

The Impact on Customer Retention

In the realm of subscription-based businesses, customer retention is paramount. I learned that companies leveraging PayKickstart are not only focusing on acquiring new subscribers but also on creating a seamless experience that keeps customers coming back. For instance, a digital course creator managed to reduce their churn rate significantly through automated billing and reminders setup in PayKickstart. They tailored their payment system to meet the unique needs of their audience, which in turn fostered a loyal customer base.

What stood out to me was how varied the approaches were that different companies took. One organization, for example, emphasized their checkout experience tailored to their target audience, making it as frictionless as possible. They reported an remarkable increase in return customers, along with decreased cart abandonment rates. The customizable nature of PayKickstart allowed this team to create a user journey that reflected their brand's identity.

Key Performance Indicators and Business Lessons

Through my research, I also found it imperative to consider key performance indicators (KPIs) when measuring the impact of PayKickstart on a business's success. Companies that actively monitored their KPIs—such as monthly recurring revenue, customer lifetime value, and churn rate—were better equipped to make informed decisions. For those unfamiliar, KPIs serve as measurable values that indicate how effectively a company is achieving its business objectives.

After observing various implementations, I came to an important realization: there's no one-size-fits-all solution. Different industries have unique challenges and customer bases that require tailored strategies. For instance, while a SaaS company may prioritize rapid affiliate engagement, a selling platform for physical goods may want to focus on optimizing its checkout process.

Understand Your Audience: Companies found that during the implementation of PayKickstart, recognizing the specific needs and behaviors of their target demographic could lead to better customer retention.

Leverage Automation: The automation features within PayKickstart allow businesses to save on precious time, focusing more on growth strategies than day-to-day management.

Monitor and Adapt: Continuous analysis of KPIs not only provided insights but also offered guidance on necessary adjustments to strategies, allowing businesses to remain agile and responsive to market trends.

Incorporating PayKickstart: A Journey of Adaptation

Adaptation has emerged as a consistent theme in these case studies. I found that successful companies did not simply adopt PayKickstart; they embarked on a journey of integration and adaptation. The process of onboarding was often accompanied by an understanding that such a transition would involve not just a software adjustment but a fundamental shift in operational mindsets.

Those who thrived clearly communicated the benefits of the transition to their teams and took the time for proper training, ultimately leading to greater utilization of the platform's features. Businesses that aligned their goals with the capabilities of PayKickstart experienced significant benefits.

For example, a company focusing on digital products noted that after integrating PayKickstart, their team felt empowered to leverage the data analytics tools available, leading to more efficient marketing campaigns and, ultimately, a boost in customer loyalty.

Interactivity and Innovation in Business Growth

I was particularly intrigued by the interactive elements offered by companies that adopted PayKickstart. The emphasis on engaging customers through interactive webinars, personalized email campaigns, and even gamified checkout processes resulted in increased customer satisfaction and better retention rates. Both old and new customers began to feel more connected to these brands, establishing a community-like atmosphere that encourages ongoing loyalty.

As I sifted through the experiences of these successful businesses, it became increasingly clear that the integration of technology, combined with personalized service, was a significant part of their strategy for growth. The ability to adapt to customer needs and iterate their processes played a pivotal role in their achievements, shaping my own understanding of best practices when considering PayKickstart as a solution.

The Takeaway

Through these case studies, I gleaned that the road to success with PayKickstart hinges on more than just deploying a tool. It requires a commitment to understanding the nuances of subscription management while effectively engaging with affiliates to maximize revenue. Each company's journey provides valuable lessons on what works and what doesn't, shining a light on the importance of customization and an unwavering focus on customer satisfaction.

While the path may vary from one business to the next, the common thread remains: investing the time and effort into mastering PayKickstart can yield remarkable results. The success stories I've explored serve as a convincing testament to the platform's potential in reshaping how businesses manage their subscriptions and affiliate programs.

Getting Started with PayKickstart: A Step-by-Step Guide

As someone who has navigated the often-choppy waters of subscription billing and affiliate management, I can tell you that finding the right platform can be a game-changer. When I first stumbled upon PayKickstart, it felt like a breath of fresh air. With over 10,000 companies utilizing its features, I realized I was in good company. This guide is all about helping you jump into the PayKickstart world, from signing up for that tempting 14-day free trial to avoiding some common pitfalls, which I wish someone would have pointed out to me back in the day.

How to Sign Up and Take Advantage of the Free Trial

First things first, signing up for PayKickstart is an absolute breeze. I can honestly say I appreciated how intuitive the process was. Simply head over to their website and click on the “Sign Up Free” button. In a matter of minutes, you’ll be ushered into a digital realm designed specifically for subscription billing. You don’t even need to enter credit card details right away – you can truly kick the tires during the two-week trial period without any upfront commitment.

Once you’ve signed up, it’s time to explore! I found that a solid first step is simply wandering around the dashboard. PayKickstart is packed with features, including billing management, affiliate programs, and analytics. As a new user, you can take advantage of the intuitive interface that makes it easy to switch from one aspect to another. I can’t stress enough how helpful this is for newcomers.

Schedule Your Free Onboarding Call: Right off the bat, I recommend scheduling a free onboarding call. The support team dives deep into helping you understand how to maximize the platform, and trust me, you’ll leave that call with a clearer understanding of how to operate effectively.

Utilize Tutorials: PayKickstart offers various tutorials that you can follow at your own pace. I found these particularly useful for navigating the more sophisticated features. No one wants to feel lost, especially not when starting a business venture, right?

Navigating the Platform: Tips for New Users

Navigating PayKickstart may seem overwhelming at first, but it helps when you break it down into bite-sized chunks. Here are some tips that might make your new journey much smoother:

Familiarize Yourself with the Dashboard: When I first logged in, I spent some time just clicking around. Understanding where everything is located (from billing to reporting) can save you hours later on.

Explore Integrations: During my exploration, I found that PayKickstart integrates with several external tools like CRMs and email marketing services. This feature can be a lifesaver. You’ll want to streamline your workflows, so try to make the most out of these integrations.

Don’t Ignore Reporting: Utilize the reporting and analytics feature. I admit, I didn’t focus on this as much initially, but it’s crucial for understanding your revenue streams and customer behavior. Make data-driven decisions right from the outset!

Common Pitfalls and How to Avoid Them

Every platform has its learning curve, and PayKickstart is no different. Here are a few challenges I faced and how I overcame them.

Integration and Setup Can Be Tricky: The first time I set everything up, I felt like I had taken a wrong turn on a one-way street. But remember, it’s about learning as you go. Utilize the resources available to guide you through the integration process!

Neglecting Customer Support: I’ll be honest; I had my share of hesitation in reaching out for support. But let me tell you, the PayKickstart team is there for you, so use the help center for any questions. It’s much better than floundering around!

Ignoring the Importance of Testing: When I began creating different checking experiences, I rushed. Bad move. Always test your checkout process and subscription flows to avoid frustrating your customers. They won’t hold back on voicing their displeasure, so do it before they get to that point.

To put it simply, understanding the nuances of PayKickstart is easier when you actively engage with the community, test features, and don’t hesitate to seek assistance. It’s worth noting that starting this journey doesn’t have to be daunting. After all, the only way to achieve success is by taking that leap—like Entrepreneur says,

“The key to success is starting before you’re ready!”

In my experience, delving into the world of PayKickstart has been rewarding. As you grow comfortable with the platform, you’ll notice that it serves as an extension of your business, allowing you to scale your subscription model whilst minimizing technical hurdles. The sheer volume of tools available makes handling billing, managing affiliates, and retaining revenue a well-oiled machine.

Moreover, the 14-day free trial allows you to explore the platform without any risky commitments. Whether you’re in digital products, services, or course creation, I found that PayKickstart has tailored solutions that can cater to any area you're in. Its competencies in billing management and affiliate programs make it a robust choice, in my opinion.

One last nugget: keep an eye on ongoing webinars and interactive sessions that PayKickstart hosts. These can give insights ranging from advanced features to fundamental operations, so why not take advantage? The information gleaned from fellow users and experts is golden.

Overall, as I weave through the processes involved in establishing my subscription service, I can genuinely recommend PayKickstart as an invaluable resource that has streamlined my operations and opened up multiple avenues for revenue growth and management. The sheer flexibility of its services makes it stand out in the market. So, if you’re ready to transform how you manage subscriptions and affiliate programs, jump onboard with PayKickstart—it’s worth every step!

The Future of Subscription Billing and Affiliate Management

As someone who's been actively observing the dynamics of the subscription economy and affiliate marketing over the years, I must say, the landscape is shifting rapidly. In today's review, I'll delve into the trends shaping these industries, my predictions for the future of affiliate marketing, and how technology will continue to transform billing practices.

Exploring Trends Shaping the Subscription Economy

Let’s not sugarcoat it: the subscription economy is booming! According to recent projections, it's expected to grow to a staggering $1.5 trillion by 2025. From streaming services to subscription boxes, businesses across various sectors are adopting this model to ensure steady revenue. I’ve witnessed firsthand how companies pivot towards subscriptions for improved predictability in their cash flow.

Sustainability seems to be the key consumer preference driving this change. Businesses that demonstrate an eco-conscious approach tend to resonate more with customers. Picture this: a subscription box that provides ethically sourced products while celebrating local artisans. Sounds appealing, right? It's clear that modern consumers are looking for values beyond just great products.

Affiliate Marketing: A Data-Driven Future

Switching gears to affiliate marketing, I see a transformative evolution on the horizon. Affiliate marketing has traditionally been based on commissions and leads, but we're entering an era that's more data-driven. Data analytics is paving the way for enhanced targeting strategies that optimize campaigns for better results. With tools powered by AI, advertisers will be able to track performance in ways that were previously unimaginable.

Think of it this way: a small business could tap into advanced analytics to refine their approach, leading to more effective partnerships. For instance, instead of merely seeing how many clicks a link got, they can analyze customer behavior post-click—understanding aspects like preferred products or customer demographics. This depth of insight is where the future of affiliate marketing lies, and it's quite exciting to anticipate.

The Continuous Change in Billing Practices

Now, let's talk technology. The pace of change is staggering. As someone who is invested in the ins and outs of billing practices, I see that tools like PayKickstart are redefining how businesses manage subscriptions and billing. Imagine having a single platform that handles everything: from the checkout experience to recurring billing management. This is a game-changer for businesses!

The seamless integration and automation mean fewer headaches when it comes to revenue retention and compliance. I have seen firsthand how companies equipped with advanced billing systems experience reduced churn rates. If a customer is having a smooth experience during checkout and management of their subscription, they're more likely to stick around. It’s as simple as that!

Emphasizing Consumer-Centered Practices

Looking ahead, I believe that affiliate marketing and subscription services will continue to evolve alongside consumer-centered practices. The trend towards personalization and tailored experiences can't be ignored. Businesses are beginning to realize that they don't just sell products—they sell experiences! By delivering personalized content, companies are likely to see an increase in customer loyalty.

The Role of Compliance and Security

Particularly in the realm of subscription services, security and compliance are becoming paramount. As technology continues to advance, so do the tactics employed by cybercriminals. Businesses must prioritize robust security measures to protect consumer data. This not only fosters trust but also ensures compliance with regulations, which is essential for long-term growth.

"Change is the only constant in business; adapt or be left behind." - Marketing Strategist

This quote truly resonates with the journey we are on—the necessity of adapting to stay relevant in this evolving ecosystem. Companies that resist change risk stagnation. Whether it’s evolving their subscription models or rethinking affiliate strategies, staying ahead of the curve is non-negotiable.

Conclusion

The future of subscription billing and affiliate management is undeniably bright. As a keen observer and participant in these fields, I've seen how technology can forge new paths and create opportunities that were previously beyond reach. It’s not just about survival; it’s about thriving in a competitive landscape!

In short, businesses must remain flexible and responsive to changing consumer behaviors. They should also be ready to leverage data insights to drive growth effectively. For anyone venturing into these sectors, embracing innovative tools and maintaining a commitment to sustainability and consumer experience will be essential. Adaptability and foresight will undoubtedly be crucial for continued success.

For more information on PayKickStart, you can check out the following URL:

- Website: https://paykickstart.com

P.S. Don't forget to follow us on social media, the community, the website and the - - YouTube channel for even more inspiration and updates!

- Website: https://thereviewshed.cc

- Website: https://van-santen-enterprises.com

- Community: https://community.van-santen-enterprises.com

- Marketing Courses: https://thetraininghub.cc

- The Store: https://van-santen-enterprises.cc

- YouTube Channel: @VanSantenEnterprises

To Learn more about "Digital Marketing" or to stay informed, subscribe to the free newsletter or community.

TL;DR: The subscription economy is on track to grow significantly, driven by sustainability and consumer preferences. Affiliate marketing is evolving into a data-driven approach, leveraging AI for optimization. Technology is reshaping billing practices, helping businesses to improve customer experiences while ensuring compliance and security. The overall future is promising for those willing to adapt and innovate.