Unlocking Your Finances with Revolut: An Australian Perspective

Average Reading Time: 6min.

Table of Contents

- What is Revolut? A Brief Introduction

- Chapter 1: Features: Tailored for the Modern Traveler

- Chapter 2: User Experiences: The Good, the Bad, and Everything In-Between

- Chapter 3: Future Considerations

- Conclusion: Is Revolut for You?

What is Revolut? A Brief Introduction

When I first stumbled upon Revolut, it was 2019, a time when I was grappling with different financial needs while traveling. Founded in the UK in 2015 by Nik Storonsky and Vlad Yatsenko, this fintech company aimed straight for the stars, and they seemed to hit the ground running. Now serving Australians, the app had already garnered an impressive user base of over 40 million personal customers globally and about 500,000 business clients.

What caught my attention was Revolut’s mission statement, which claims,

"Revolut aims to do all things money in just a few taps."

This resonated with me because like many, I often found managing money a bit overwhelming. While exploring its features, I couldn't help but wonder if this tool could bridge the gap between my financial aspirations and the complexities of modern banking.

My journey with Revolut began with curiosity—curiosity about whether a fintech baby could really compete with the established giants of the banking world. The user reviews I read, like the 2.3 average rating out of 5 stars on productreview.com.au, hinted at a mixed bag. Some people were thrilled by its ease of use while others vented frustrations about blocked transactions and customer service woes. I was intrigued—could this app really live up to the hype?

Revolut’s Growth Appeal

When I think about the trajectory of Revolut, the numbers are astonishing. The jump from zero to 40 million users in just a few short years is, frankly, impressive. The rapid growth indicates a demand for alternative financial solutions, particularly as traditional banks often seem outdated in their approach. However, I learned that growth isn’t always synonymous with quality—many users still report challenges, particularly when it comes to support. My skepticism was piqued.

During my research, I learned that Revolut offers three personal account types aimed at different users—Standard, Premium, and Metal. This broad offering piqued my interest because I appreciate a company that recognizes diverse customer needs. As I navigated through various plans, it was clear that Revolut’s appeal is multifaceted, not just limited to casual users. It's also tailored for businesses and even accounts for those under 18, broadening its reach significantly.

Customer Experiences

As with any financial service, the individual experiences vary widely, and it was refreshing to see both sides. Users praising Revolut often highlighted how simple it was for managing money internationally. Potential travelers like myself seem to find benefit in fee-free spending and the ability to hold multiple currencies in one app. On the other hand, tales of frustration emerged when customers talked about blocked transactions without warning, making me question the reliability of this seemingly streamlined service.

It’s this dichotomy of experiences that kept me engaged, leading me to dive deeper into the specific features offered by Revolut. For someone like me, who enjoys traveling, spending abroad without excessive fees could save a considerable amount of money. In fact, the ability to send money to over 150 countries in more than 30 currencies seemed almost too good to be true. But was it worth the risks?

Valuation of Revolut’s Cost Structure

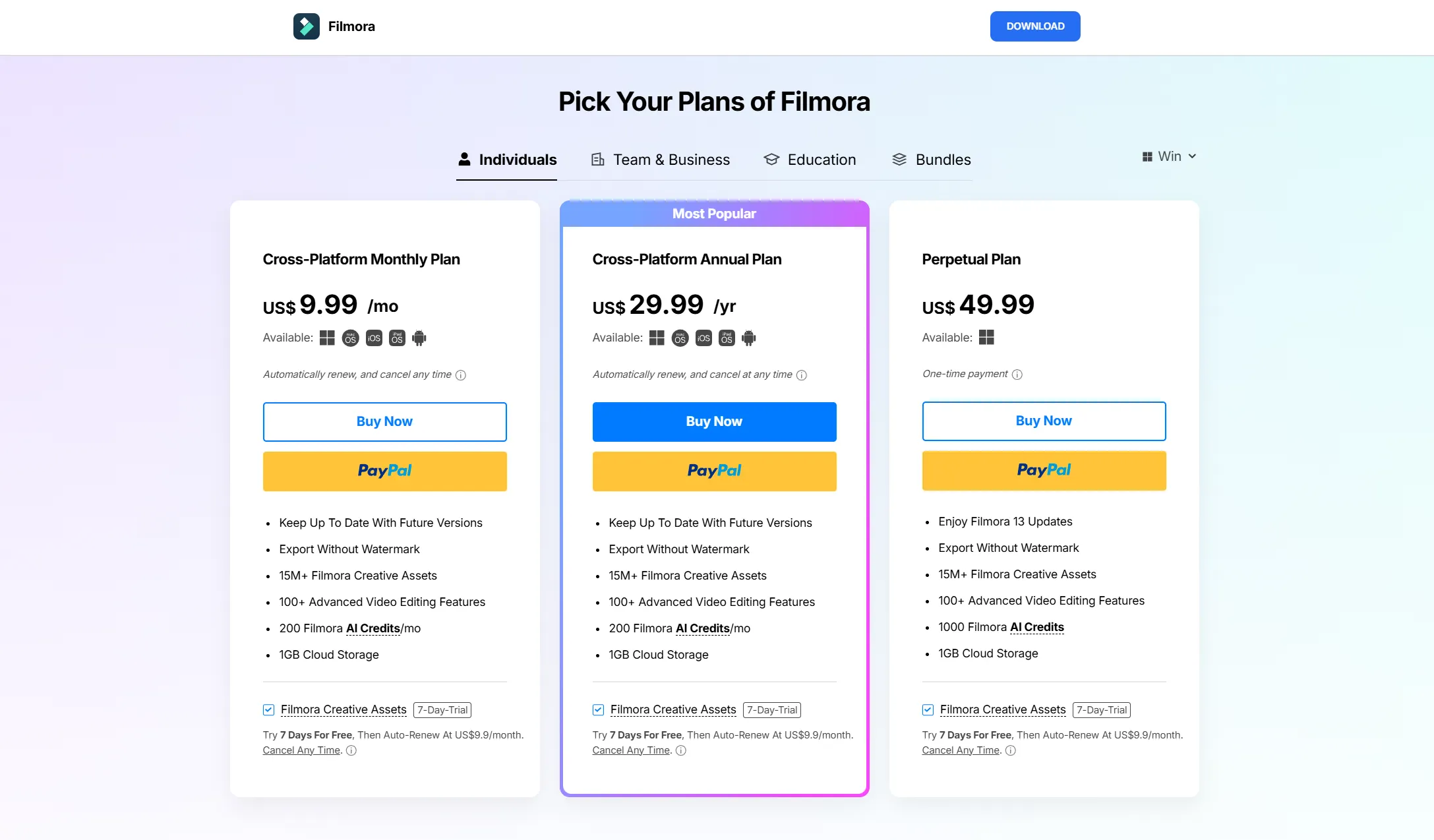

Diving into the cost breakdown of Revolut, it became evident that their pricing structure is quite competitive compared to traditional banks and even other fintech services. The Revolut Standard account is free, which immediately grabbed my attention. The Premium plan, priced at $9.99 monthly or $99 annually, and the Metal plan at $24.99 monthly or $225 annually, offered more features but also raised questions about their practicality for everyday users.

Understanding the Fees

It’s essential to delve into fees, especially when I consider how quickly little charges can add up. For instance, there are no charges for adding money to your Revolut account via bank transfers or certain card types. However, if you’re using an Australian credit or corporate card, you're immediately slapped with a 1% fee on top of your contribution. For a $500 deposit, $5 may not seem that awful, but in my experience, unexpected costs can add up—especially during international travel.

ATM withdrawals are capped at $350 per month on the Standard plan, and surpassing this cap incurs a 2% charge. Not the most appealing mathematical insight—I found myself calculating these figures as travel plans took shape. The Premium plan allows for twice the withdrawal and certainly sounds tempting. Yet, this makes me think about the lifestyle I lead and whether I’d benefit from the extra features that come at those higher prices.

Feature-Rich Accounts

After digging through reviews and comparison sites, I’ve discovered a range of benefits that come with each account tier. I’ve come to appreciate that all plans allow you to spend internationally without the fear of high fees (within the set limits). Additionally, shopping online becomes a bit more secure with their Revolut Chrome extension—a feature that genuinely speaks to me.

The Premium plan adds an alluring 60% discount on international payment fees, prioritized customer support, and even five commission-free stock trades. The Metal plan goes further with cashback on card payments and extended commission-free trades, but at such a price, I questioned whether these additional perks were truly worth the monthly commitment.

A Blend of Crypto and Traditional Currency

With the increasing popularity of cryptocurrencies, I felt it crucial to understand Revolut's stance on this. Their offerings span multiple currencies, and I was intrigued to see how they handle cryptocurrency transactions. The Standard plan crypto fee stands at 1.49%. However, it drops to 0.99% with Premium and remains appealing in the realm of crypto trading. Some might say that fees should always be carefully considered when choosing where to invest or trade.

Your Thoughts on Using a Fintech App

As I reflect on my journey with Revolut, I sit here contemplating various factors—usability, fee structures, and user reviews that speak volumes about the challenges others have faced. I wouldn't rush to categorize Revolut as a catch-all solution. After all, collective user experiences vary substantially, leading me to wonder how well it will adapt to the unique financial needs presented by customers like myself. The ease of managing finances in a single app is undoubtedly appealing, yet the reliability in customer service and transaction security remains paramount on my list of concerns.

In short, Revolut has undeniably made its mark on the fintech world, especially among travelers and those looking for an alternative to traditional banking. Yet, as with all financial products, it's essential to ponder before diving into an app that celebrates innovation but also draws mixed reviews. How many of us are willing to trust our hard-earned cash to a platform that still has room for growth in customer service? Time will tell if Revolut can transform its potential into the kind of user satisfaction that breeds loyalty.

Features: Tailored for the Modern Traveler

As a frequent traveler, I've always been on the lookout for financial tools that simplify international spending and enhance the travel experience. My journey with Revolut has been nothing short of transformative. Allow me to share my insights on how this fintech powerhouse has become essential to my travels.

International Spending without Hidden Fees

Imagine standing in a bustling market in Bangkok, picking up some local artisanal goods. With Revolut, I've enjoyed the freedom to spend in over 30 currencies without the fear of hidden fees munching away at my funds. This is not just convenience; for me, it signifies a significant shift in how I navigate my finances abroad.

A key detail that made me a fan is Revolut's ability to convert currencies at interbank rates. I remember being able to buy souvenirs without worrying about additional conversion fees eating into my budget. According to my calculations, being able to skip average conversion fees of around 3% was a game changer. With Revolut, I feel empowered, not limited!

Unique Features: Crypto Exchange and Stock Trading

Revolut provides a suite of financial services that extend beyond just spending and saving. With its crypto exchange feature, I embarked on a journey into cryptocurrency while on my travels. Imagine trading Bitcoin at a café in Berlin! It felt like stepping into the future. With accessible trades and a user-friendly interface, even my not-so-tech-savvy friends were impressed and intrigued.

What about those of us who enjoy dabbling in stocks? Revolut’s platform also offers commission-free stock trading on its Premium plan. I was able to keep my investment portfolio active without incurring costs that can add up. I can jet off on my adventures while ensuring my finances remain dynamic and responsive.

Budgeting Tools: A Lifesaver for Travelers

One aspect of Revolut that has truly impressed me is its innovative budgeting tools. Using these features, I can set budgets for various categories like food, accommodation, and transportation. My personal favorite? The cost notifications and spending insights that keep me aligned with my financial goals. For someone like me, who has occasionally gone off the rails when it comes to spending, this feature has been downright crucial!

Don't take my word for it—many travelers echo my sentiments. A fellow adventurer shared with me,

"With Revolut, my travel expenses were simplified, and I avoided currency conversion fees."

Hearing these user experiences reminded me that I'm not alone in my reliance on these features. They truly do enhance the travel experience.

Data That Matters

To give you a grasp of just how comprehensive Revolut is, consider some important figures:

- Over 30 currencies available for exchange

- 60% off international fees with Premium plan

When I compare this with traditional banking or older financial services, the difference is alarming. I no longer have to pay an arm and a leg just to manage my money as I explore new cultures.

Peer Experiences: A Layer of Insight

As I delved deeper into the world of Revolut, I couldn't help but discuss my experiences with fellow travelers. Their insights lent a valuable layer to understanding how Revolut is perceived across the globe. From easy withdrawals from ATMs in foreign cities to smooth currency transfers during trips, the feedback was overwhelmingly positive.

Still, it's essential to remain informed about the drawbacks. There were mentions of customer service challenges—something I also experienced once when my card was temporarily blocked during an overseas trip. However, knowing others faced similar hurdles alleviated my frustration; the company is growing, and so are its services.

In Summary

For anyone considering a travel-centric financial tool, Revolut stands out as a fantastic option. The ability to enjoy international spending without hidden fees, combined with unique features like crypto trading and meaningful budgeting tools, creates a tailored experience for the modern traveler. Plus, the community of users offers support and shared experiences that enrich the journey further.

Personally, I can't recommend Revolut enough for those wanting to navigate their finances with ease while traveling. If you haven’t given it a shot yet, I highly encourage you to explore its offering. You might surprise yourself with the simple joys of managing your money the smart way!

User Experiences: The Good, the Bad, and Everything In-Between

As someone who has ventured into the world of digital banking, I’ve had my fair share of experiences with various financial services—some stellar and some not so much. Today, I want to dive deep into my encounters with Revolut, a fintech service that has been making waves across the globe and down here in Australia since 2019. With over 40 million personal customers using their platform, I felt it important to share both the highs and lows of my journey with Revolut, particularly focusing on their customer support, successful transactions, and how they stack up against competitors.

The Topsy-Turvy Tale of Customer Support

Ah, customer support—undoubtedly a crucial factor when you're dealing with financial matters. My first interaction with Revolut’s customer support wasn’t particularly smooth. After facing an issue where my card was unexpectedly blocked during what should have been a routine transaction, I decided it was time to reach out for help. Little did I know that the waiting game had just begun.

Despite multiple attempts via their in-app chat function, I found myself staring at the dreaded “please hold” message for what felt like an eternity. My frustration level was palpable. You know what they say: "When it works, it’s fantastic! But God help you if it doesn’t." This sentiment is echoed by many who share a similar fate, and it paints a sobering picture of what people experience when they hit a snag.

Eventually, I was able to connect with a representative, who was polite but didn’t entirely solve my issue right away. I had to jump through some hoops, verifying my identity multiple times, which, let’s be real, is a valid request for a financial institution. But it felt excessive given the situation.

Comparing this experience to other fintechs, like Wise or Xe Money Transfer, I found their customer support systems to be more straightforward and user-friendly, with quicker response times. This highlighted an area where Revolut could certainly improve. I believe that a responsive and efficient support system is equally important as the features themselves, especially when managing one's finances.

Success Stories: When Everything Goes Right

On a brighter note, there have been times when my transactions with Revolut were smooth sailing. I remember heading off on a holiday to Europe, and I was a bit anxious about currency exchange. However, I was pleasantly surprised by how easy it was to buy foreign currencies right from the app. With just a few taps, I had euros in moments. Talk about a relief!

Once I arrived, I withdrew cash from an ATM with zero fees—well, within my allowance, of course. As a standard user, I had a limit of five withdrawals or $350 per month, whichever came first. This worked perfectly during my trip since I was within those limits. The convenience of using a single card to manage all my spending, both in the form of cash and card payments, was simply delightful.

My positive interactions extended to the notifications I received for any transactions. Real-time spending notifications were a game changer. They kept me on top of my finances, ensuring I never overspent, even while enjoying the occasional splurge on vacation. When all goes according to plan, Revolut shines, providing a seamless experience particularly conducive for travelers.

Weighing the Pros and Cons Against Competitors

While there are moments of clear brilliance, it's essential to juxtapose these against the experiences I had with competitors. For example, Wise has an incredibly transparent fee structure for international transfers. I found their rates to be competitive, which would sway a money-conscious traveler like me. Revolut charges fees on certain transactions, and while they are generally lower than the traditional banks, there were instances where I felt they could be more upfront about it.

Additionally, while Revolut offers enticing features such as cryptocurrency trading and commodity exchanges, I have yet to utilize these functionalities myself. For someone who isn't heavily invested in trading, these features feel somewhat like seasoning on a well-cooked dish; it's great, but not essential. On the other hand, I gravitate towards services that offer straightforward currency exchange without hidden fees, which Wise handled effortlessly.

To illustrate this, I noticed when transferring $500 AUD to a GBP account via Revolut, I was charged a modest $1.50 while Wise offered similar transfers sans the extra charges. This made me revisit my payment strategy and question whether I could achieve better flexibility and outcome through other platforms.

Reality of Withdrawal Limits and Fees

As a standard user, the ATM withdrawal allowance of up to $350 per month was, at times, adequate. However, there have been occasions where I had to withdraw more for specific expenses like excursions or dining in high-cost areas. It was frustrating to realize that once I exceeded my limit, I was subject to a 2% fee on additional withdrawals, plus a minimum fee of $1.50. In contrast, the competitor services often advertised fee-free withdrawal options under various circumstances.

It's worth noting that each plan revolved around fair usage limits, setting thresholds on exchanges made within the app and across currencies. While I do appreciate the ability to transfer funds internationally in over 30 currencies, these limits can be a hindrance. I often found myself having to plan my transactions strategically, and while that may be part of financial discipline, it's not the ultimate convenience I seek from a modern-day bank.

The Bottom Line: A Mixed Bag Experience

In summary, my journey with Revolut encapsulates a mix of euphoric highs and frustrating lows. The ease of use and convenience provided during my travels was commendable, yet the customer support struggle and transaction constraints elicited doubts about their overall efficiency as a fintech service.

Ultimately, I find that customer satisfaction largely hinges on what users prioritize. If you value seamless currency exposure and innovative finance management, then Revolut could be a terrific choice. But if having dependable customer service and exceptional transparency in fees is your jam, it might be wise to explore your options with competitors.

The takeaway here is to weigh your personal needs against what's available in the market. In the fintech landscape, there are always pros and cons to both sides; the key is identifying what aligns with your financial lifestyle and expectations.

Future Considerations

As I reflect on my experience with Revolut, I find myself at a fascinating crossroads in the fintech landscape. From its inception in the UK to its foray into the Australian market, Revolut has evolved significantly. With over 40 million personal accounts globally, it surely has struck a chord among many consumers who are looking for modern, user-friendly financial tools. But what does the future hold for Revolut? Let’s delve deeper.

Assessment of Revolut as a Financial Tool Moving Forward

Revolut's impressive growth trajectory is undoubtedly compelling. Serving nearly three million Australians since 2019, the app has become a go-to platform for managing finances on the go. I have found the app not only easy to navigate but packed with features that cater to both the everyday user and the cryptocurrency enthusiast. The ability to hold multiple currencies and make international transfers with competitive fees certainly sets it apart from traditional banks.

However, while my experience has generally been positive, it hasn’t been without its hiccups. The platform has garnered mixed feedback, marked by a 2.3 out of 5-star rating on ProductReview.com.au. Some users, including myself on a few occasions, faced challenges related to transaction blocks or customer service response delays. These issues have raised some concerns about the app’s reliability in urgent financial situations. Thus, as I consider the future, it’s crucial for Revolut to enhance its customer service and streamline its operations.

Predictions Based on Current Trends in Fintech

The fintech industry is in constant flux, and Revolut seems poised to adapt. Many market experts anticipate that digital wallets and contactless payments will dominate in the coming years. With roughly 45 million customers globally, Revolut is well-positioned to implement new technologies and features that align with these trends. For instance, integrating advanced AI features for personalized budgeting or virtual financial advice could greatly enhance user experience. I believe these innovations could propel Revolut further ahead in the competitive fintech landscape.

Moreover, as financial literacy becomes more mainstream, companies like Revolut have the chance to offer educational resources within their platforms. Imagine personalized financial workshops or webinars tailored to different user needs. In my experience, these resources can empower users to make informed financial decisions while sticking to their goals — a win-win for both the company and the customers.

Risks and Rewards: Is It Worth Diving Deeper into Using Revolut?

The concept of diving deeper into any financial application is always met with some level of skepticism. So, is it worth the risk with Revolut? While the potential rewards are enticing — from banking without borders to cryptocurrency trading at our fingertips — there are factors to consider before fully committing. As I see it, the key risks include potential security issues and account restrictions, especially during transactions that appear unusual or high-value to the algorithm. As a user, it’s imperative to be aware of these limitations and use the platform prudently.

On the flip side, the advantages are notable. For those who travel frequently or earn in multiple currencies, Revolut simplifies the management of finances remarkably. Moreover, the ability to instantly exchange currencies in real-time has saved me quite a bit on fees compared to traditional banks. Thus, the intrinsic value of the platform cannot be underestimated, especially for savvy users looking to manipulate their finances effectively.

The Evolution of Revolut’s Strategy

Revolut’s strategy has been continuously evolving, and recent marketing push into Australia indicates it’s not slowing down. I’ve kept an eye on how they’re branching out their offerings, which includes adding features that cater to investment and insurance. With advancements in machine learning and data analytics, the company is set to expand its portfolio of services even further.

What’s particularly intriguing is their focus on providing a seamless user experience. The app has made strides in boosting its usability, and I appreciate how they incorporate user feedback into updates. This indicates a customer-centric approach that not all fintech apps exhibit, which, in my opinion, adds significant value to their services.

“Fintech is the future, but choose your platforms wisely.” - Financial analyst insight

Conclusion: Is Revolut For You?

If you're considering diving into the world of Revolut, I implore you to weigh your choices carefully. While the platform offers incredible features and the promise of limitless financial management, it’s crucial to familiarize yourself with its terms, conditions, and potential risks. Take a moment to evaluate your financial habits — do you travel frequently? Are you comfortable managing currencies? What level of customer service do you expect?

At the end of the day, Revolut may not be the best fit for everyone, especially amid the mixed reviews. However, for those who are looking for a modern approach to finance with a focus on travel and innovation, it could be a worthwhile investment. As I conclude this reflection, it’s essential to remember the rapidly changing landscape of fintech, which continuously influences the tools at our disposal.

In summary, Revolut shows promise for the future, and its user base is likely to grow, bringing with it potential improvements and innovations. Just bear in mind, as with any financial service, careful consideration of your unique situation and a willingness to keep tabs on the platform’s evolving features are crucial to navigating its landscape successfully.

For more information on Revolut, you can check out the following URL:

- Website: https://revolut.com

P.S. Don't forget to follow us on social media, the community, the website and the - - YouTube channel for even more inspiration and updates!

- Website: https://thereviewshed.cc

- Website: https://van-santen-enterprises.com

- Community: https://community.van-santen-enterprises.com

- Marketing Courses: https://thetraininghub.cc

- The Store: https://van-santen-enterprises.cc

- YouTube Channel: @VanSantenEnterprises

To Learn more about "Digital Marketing" or to stay informed, subscribe to the free newsletter or community.

FintechInAustralia, #RevolutReview, #AccountFeatures, #InternationalTransfers, #MoneyManagement, #Revolut, #DigitalBankRevolut

TL;DR: Revolut offers a modern financial management tool that caters well to those who travel or manage multiple currencies. While there are customer service challenges and fees involved, its growth and changing features indicate it could be a solid choice for savvy users. Always weigh your financial habits and needs before diving in.